are car loan interest payments tax deductible

If you use a van regularly for your private use you can claim assessable van benefit which is currently. The standard mileage rate already.

Auto Loan Prepayment Clauses Avoid Paying More Bankrate

Car loan interest is tax deductible if its a business vehicle.

/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

. 10 x the number of days for which interest was payable. For vehicles purchased between December. May 10 2018.

Of course there is a caveat and its why most people cant use their loan payments as a tax deduction. The interest you pay on student loans and mortgage loans is tax-deductible. Interest paid on personal loans is not tax deductible.

If youre claiming 50 percent business use for taxes your. As a rule of thumb interest paid on a car loan home equity loans credit card debt or loans used for. You paid 25000 for the car and you have a 10 percent interest rate which gives you 2500 in loan interest.

For tax purposes a van is within the category of plant or machinery. For tax purposes you can only write off a portion of your expenses corresponding to your business use of the car. Unfortunately car loan interest isnt deductible for all taxpayers.

As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit. This means you can deduct some of the cars value from the profits of your business before paying tax. You actually should be able to.

The tax rebates you can claim if youve taken out a chattel mortgage include the GST you paid when buying the car the loan interest youre paying and the cars depreciation. Should you use your car for work and youre an employee you cant write off any of the interest you pay on. You cannot deduct the actual car operating costs if you choose the standard mileage rate.

For example if 70 of your car use was for business and 30 for personal affairs then you can only deduct 70 of the car loan interest from your tax returns. 10 Interest on Car Loan 10 of Rs. Experts agree that auto loan interest charges arent inherently deductible.

This is true for bank and credit union loans car loans credit card debt lines. F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. If a personal loan is being used for mixed purposes like a car loan with the car split between business and personal use then the portion of the interest thats deductible is proportional.

This is why you need to list your vehicle as a business expense if you wish to deduct the interest. Business Loans In most cases the interest you pay on your business loan is tax deductible. You may claim the cost of a car as a capital allowance.

But typically only mortgage interest qualifies for a tax deduction. Answered on Dec 03 2021. Reporting the interest from these loans as a tax deduction is fairly straightforward.

However for commercial car vehicle and. To deduct interest on passenger vehicle loans take the lesser amount of either. If you borrow to buy a car for personal use or to cover other personal expenses the interest you pay on that loan does.

For example if your car use is 60 business and 40.

What Is A Good Apr For A Car Loan It Depends On Your Credit Score

/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

5 Reasons To Make A Car Down Payment Credit Karma

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Is Car Loan Interest Tax Deductible Lantern By Sofi

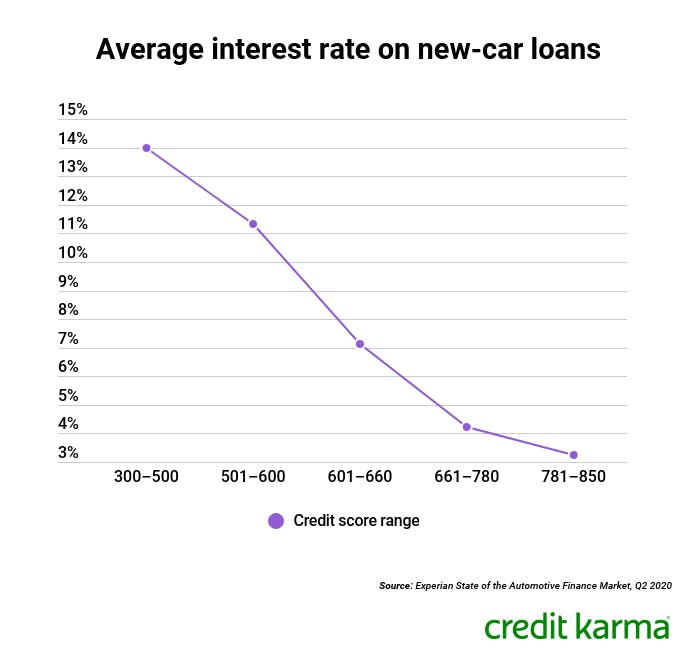

Auto Loan Rates By Credit Score Experian

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

How To Get A Car Loan With Bad Credit Forbes Advisor

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

How Does Interest On A Car Loan Work Credit Karma

3 Factors Affecting Your Car Loan Payment Credit Karma

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

What Are Interest Rates How Does Interest Work Credit Org

Tax Benefits On Car Loan What Is It How To Claim Tax Benefits Idfc First Bank

How To Get A Car Loan With Bad Credit Credit Karma

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

What S The Minimum Credit Score For A Car Loan Credit Karma

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)